by Daniel Brouse

June 8, 2023

The Economic Monsters: Inflation and Interest Rates

I Economic Forecast = Inflation (2018)

II Inflation Bites (2022)

III U.S. Mass Consumption Results in Global Economic Disparity, Inequity, and Poverty (2023)

IV Investment Recommendation: Savings Bonds / I Bonds (2023)

Part V: Your National Debt

The federal government currently has $31.83 trillion in federal debt. So, what does that mean to you?

Some economists say it doesn’t mean anything. As long as the U.S. dollar remains the world’s reserve currency, the federal government can spend without limit. Other economists disagree.

Here is what to watch for:

1. a declining influence of the dollar as the world reserve currency

The dollar has been falling out of favor with many world economies. The dollar has also been sanctioned to be used by many countries and companies. Though efforts by groups like BRICS (Brazil, Russia, India, China, and South Africa) to form their own reserve currency will likely fail, the overall dependency on the dollar is weakening. The dollar will not be able to go on with “business as usual”.

2. the amount of debt (bills, notes, bonds) being sold by the Treasury

In 2023, Congress suspended the debt ceiling. During the April – June 2023 quarter and the Treasury said, “Treasury expects to borrow $726 billion in privately-held net marketable debt, assuming an end-of-June cash balance of $550 billion. The borrowing estimate is $449 billion higher than announced in January 2023.” Now that the debt ceiling has been suspended the Treasury is staring a $1tn borrowing drive. The trillion-dollar borrowing spree will have many impacts. For instance The Financial Times reports, “analysts fear scale of new issuance following debt ceiling fight will push up yields and suck cash out of deposits.” As investors pull their savings out of bank accounts and put it into high yielding Treasuries, this will put an added burden on the already struggling banking sector and further put into play the role of the Federal Reserve.

3. the amount of national debt being bought by the Federal Reserve

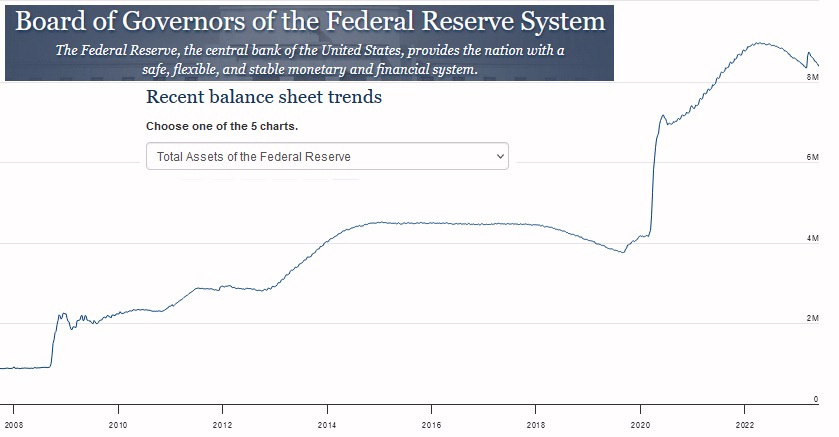

What will the Federal Reserve do? In the Spring of 2022, the Fed said they would not only stop buying Treasuries, but they would also start selling their Treasury assets. Initially, the Fed said the inflation was transitory. They were wrong. In order to fight inflation, the Fed needed to raise interest rates and reduce their assets (Treasuries). The Federal Reserve really shouldn’t be holding assets in the first place. During the financial crisis of 2007-2014, the Federal Reserve started buying trillions of dollars of assets including Treasury securities. Then during the COVID financial crisis, the Fed bought trillions more. In 2022, the Fed did stop buying Treasuries and as the securities matured, the Fed did not participate in as many Treasury rollovers. (Treasury rollover describes the process by which principal payments from maturing Treasury securities held by the SOMA are reinvested in newly auctioned securities.) However, in the graph below you see a sudden uptick in 2023.

The spike in assets in the Spring of 2023 was due to bank failures. The failing banks had billions of dollars in Treasuries that had lost value due to the rising interest rates. When interest rates go up, the value of existing lower yielding securities goes down. So, the Fed bought the devalued assets at full face value. The Fed may also have intervened in the markets to prop up the price of marketable securities in the open market.

What’s Next?

All of these interventions by the Fed have failed to bring inflation down to an acceptable level. Now the Treasury is going to borrow an addition 1 trillion dollars further increasing the demands on borrowing, interest rates, and the banking system. In fact, anything further the Fed does may stoke inflation. If the Fed buys more Treasuries, interest rates will be subsidized lower stimulating inflation. It will in effect be the same as printing money. Rising interest rates will increase the National Debt. Increasing the National Debt will raise interest rates. It is a vicious circle.

While our fiscal and monetary mess is unraveling, the costs of climate change are growing exponentially. Included in the debt ceiling suspension is a provision for unlimited emergency federal spending. Unfortunately this means that the government can continue to ignore the causes of climate change and instead give trillion dollar subsidies to the fossil fuel industry through emergency disaster relief. Yes, another vicious circle — more fossil fuels subsidies result in more climate catastrophes… resulting in more fossil fuel subsidies, etc. The end result will be additional trillions in government borrowing while the standard of living declines.

Recommendations

Given the above, our outlook and recommendations remain the same — persistent inflation and higher interest rates. Individual investors should max-out their annual I Bonds of up to $10k. Leftover saving should be invested in 4-week and 26-week Treasury bills. At maturity securities should be rolled over for the same length of time UNTIL interest rates peak. At that time, longer maturities should be considered.

BONUS

You can make all your transactions commission free at Treasury Direct. Marketable Treasuries are issued at a discounted rate. That means you get paid your interest in advance (giving you an even higher rate of return.)

The Economic Monsters: Inflation and Interest Rates

- Economic Forecast = Inflation (2018)

- Inflation Bites (2022)

- U.S. Mass Consumption Results in Global Economic Disparity, Inequity, and Poverty (2023)

- Investment Recommendation: Savings Bonds / I Bonds

- Your National Debt