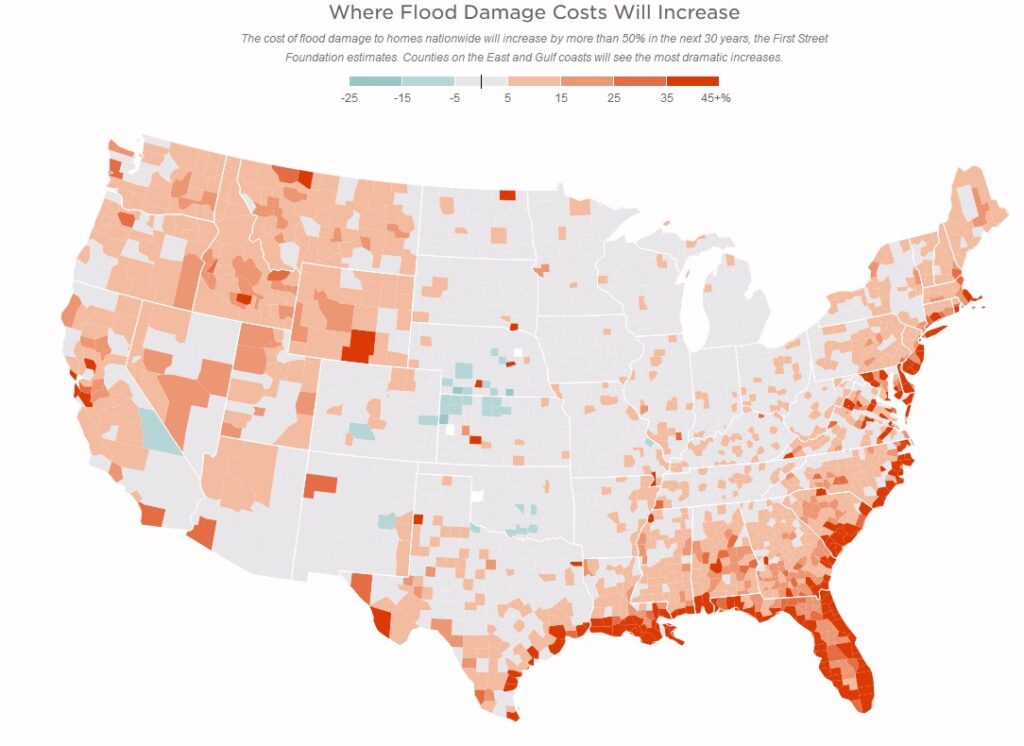

The cost of flood damage to homes nationwide will increase by more than 50% in the next 30 years, the First Street Foundation estimates.

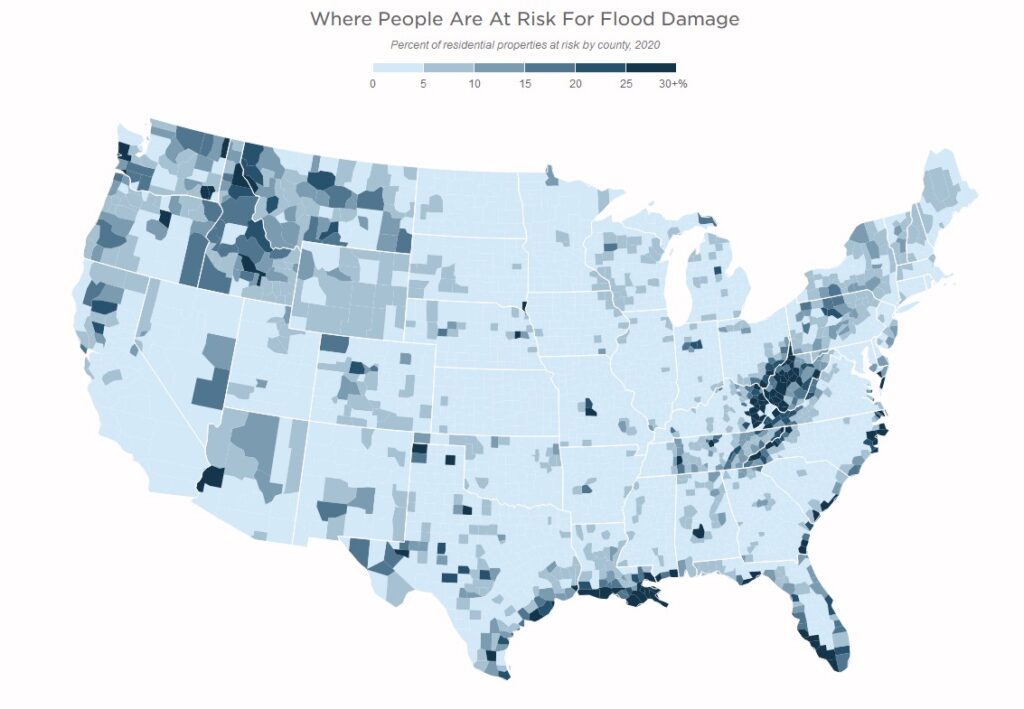

A report by NPR radio, A Looming Disaster: New Data Reveal Where Flood Damage Is An Existential Threat, found:

The federal government provides the vast majority of residential flood insurance in the U.S. Most policies are underpriced relative to the actual cost of flood damage.

The new data show that flood insurance rates would need to more than quadruple to keep up with the costs of climate-driven flooding. The Federal Emergency Management Agency is already preparing to raise insurance premiums in many places later this year in an effort to save the National Flood Insurance Program, which has accrued more than $36 billion in debt.

FEMA warns that the First Street Foundation’s analysis is only an estimate and that FEMA didn’t provide the research group with details about the new flood insurance pricing plan, known as Risk Rating 2.0.

“Any entity claiming that they can provide insight or comparison to the Risk Rating 2.0 initiative, including premium amounts, is misinformed and setting public expectations that are not based in fact,” writes David Maurstad, the senior executive of the National Flood Insurance Program, in an email to NPR. “While entities are free to suggest or estimate their opinion of what flood insurance premiums should be, they are offering exactly that — an opinion — and they do not have insight into the Risk Rating 2.0 initiative.”

For homeowners who are currently underpaying for flood insurance, FEMA says it plans to raise rates by up to 18% each year until the price is accurate, according to a January report by the Congressional Research Service. The agency will begin rolling out the new pricing in October.

As the cost of insurance goes up, many people who need flood insurance will likely be unable to afford it, leaving them to face lasting damage. Research has found that disasters can erode family stability and exacerbate mental and physical ailments when people don’t have the money they need to repair their homes.

“If you don’t have the finances you need to recover, then families have to make really difficult trade-offs, like maybe forgo spending on medical expenses because otherwise you don’t have a safe home,” says Carolyn Kousky, the executive director of the Wharton Risk Management and Decision Processes Center at the University of Pennsylvania.

More articles on Flood Insurance, Rising Sea Levels and Global Warming.