by Daniel Brouse

April 10, 2025

How Some of the Biggest Market Gains Are Actually Signs of the Worst Losses

Those who appeared to be first, ended up last. Those who appeared to be last, ended up first.

April 9 wasn’t just another volatile day on Wall Street — it was a near-perfect example of how markets behave during a crash, and why some of the biggest one-day rallies in history often happen inside brutal bear markets.

It’s one of the great paradoxes of investing:

The biggest up-days don’t mean recovery — they often signal panic, forced liquidation, and deeper instability ahead.

What Actually Happened?

In essence, the trillions of dollars that appeared to be gains in the market were really losses for short sellers. That’s the hidden truth of sharp rallies during a crash — the money didn’t come from real investment demand; it came from forced buying.

The key difference is this: when markets rise under normal conditions, long-term investors have unrealized gains — profits on paper, but not yet cashed out. But in a short squeeze, those unrealized gains for stockholders are directly matched by realized losses for short sellers who are forced to buy at any price to cover their positions.

It’s not wealth creation — it’s wealth transfer under pressure. In the chaos of a market crash, those who looked like winners became losers — and those who looked like losers became winners.

The Mechanics

Markets spiked sharply after a sudden and dramatic policy reversal was announced — a move investors hoped might slow down the economic freefall.

But here’s the key:

This initial surge wasn’t organic buying. It was mechanical.

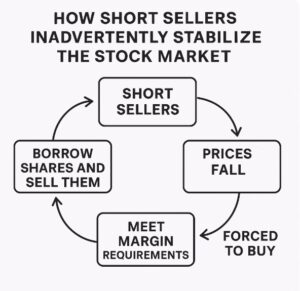

→ Short sellers — traders betting against the market — suddenly got squeezed.

→ When prices jump too fast, short sellers face margin calls — demands from brokers to put up more money or buy back the stock they bet against.

→ Since short-selling carries unlimited loss potential, these traders are forced to buy shares no matter the price to avoid catastrophic losses.

That panic buying drives prices even higher, triggering more margin calls in a dangerous feedback loop.

Why Does This Matter?

Because once those short positions are closed (covered), the artificial buying pressure evaporates.

And here’s the brutal part:

→ Many of those same shares bought in a panic are quickly sold again by longer-term bearish investors or funds desperate to raise cash.

That’s what you saw today — the so-called “pullback” was not just natural volatility; it was the aftershock of forced buying unwinding itself.

Markets gave back much of yesterday’s gains. And worse, they are now at risk of retesting — or breaking — the recent lows.

The Illusion of Safety

In chaotic markets like this, price action becomes non-linear and unpredictable.

Massive rallies during a downturn are not necessarily signs of strength — they are often signs of extreme stress within the system.

This is why some of the biggest single-day gains in market history occurred during the Great Depression, the 2008 Financial Crisis, and the early phases of COVID’s market panic.

It’s not recovery.

It’s chaos.

Why Crashes Look Like This: Forced Buyers Meet Forced Sellers

Several key forces converge during these phases:

-

Short-sellers covering in panic.

-

Margin calls across hedge funds and leveraged traders.

-

Index funds and mutual funds, required to stay fully invested, reluctantly buying dips.

-

Passive investing structures amplifying volatility both directions.

-

Algorithmic trading chasing momentum.

These dynamics create a dangerous loop:

→ Sharp rallies from forced buying.

→ Followed by brutal reversals from forced selling.

The result?

A jagged, chaotic pattern — not a smooth decline.

And the Most Important Lesson:

In a true crash, there is no guaranteed floor.

Support levels only exist until panic overwhelms them. Fundamentals don’t matter when liquidity disappears.

Markets become driven by positioning, margin calls, and liquidity — not valuation.

This is why the old phrase still applies:

“Bear market rallies are designed to fool the maximum number of people in the minimum amount of time.”

Closing Thought:

The real danger today isn’t just volatility — it’s the fact that this is largely self-inflicted economic destruction.

Policy mistakes — from trade wars to immigration freezes to climate inaction to protectionist tariffs — have combined into a global slowdown unlike anything since the Great Depression.

And unlike past crashes, there is a real risk this time that the damage is structural — not cyclical.

Recovery is not guaranteed.

- Credit War!

- Tariffs and the Liquidity Crisis in Long U.S. Treasuries

- Primer: The Chaos Theory of Crashing Markets

- Dump Trump: Buy and Hold Doesn’t Hold

- Mandated Buyers vs Emotional Sellers: The Battle Behind Every Crash

(Why doesn’t the stock market just crash in a straight line?) - The Great Depression vs. The Climate Crisis: Why the Stock Market May Never Recover