By Daniel Brouse

January 30, 2021

This is a more detailed answer to how puts work using GameStop (GME) as an example:

There are two entities. One owns 100 shares of GME. This entity believes the stock price will remain stable or go up. Lets call this entity U. Another entity thinks the price of the stock will go down. Lets call this entity Melvin.

This transaction took place when the stock price was $5/share.

Melvin comes to U and says I would like to borrow your 100 shares of GME for the next 90 days. Melvin agrees to pay U $1/share for this contract. U gets $100. U gets to keep that money no matter what and gets their 100 shares back in 90 days.

Melvin thinks the stock price is going down in the future… so, Melvin goes out and sells the 100 shares for $5/share. If the price of the stock goes down to $4/share, Melvin can buy back the 100 shares and make $100. (500-400=100). Melvin paid U $100. Melvin breaks even. The most Melvin can make on this deal is $4/share. If the price goes down to $0.01, Melvin can buy back 100/shares for a dollar. 500-100 (contract fee to U)-$1(to buy back the shares) = $399 profit.

On the other hand, if Melvin sells the 100 shares at the market rate of $5/share and the price of the stock goes up, the downside for Melvin is infinite. So, Melvin’s brokerage firm puts limits on how much Melvin can lose. As the price of the stock goes higher, the brokerage firm starts to make “margin calls”. For instance, if the price of the stock goes to $10/share, the brokerage may say Melvin needs to cover half of your shares. Instead of having 100 of U’s shares outstanding, Melvin has to go to the market and buy 50 of U’s shares back at $10/share. Then, if the stock continues to go up to say $15/share, Melvin’s brokerage makes another margin call making Melvin “cover” their outstanding shares by another 50%. Melvin then goes back to the market and buys another 25 shares at $15/share… and so on.

At the end of the 90 days, U get your 100 shares back. U can do with them as U please, and U get to keep the initial $100.

There are no good guys and bad guys. Anyone is allowed to do this. You do not have to be rich or from Wall Street. Instead of playing the side Melvin played, I recommend playing the role of U. It is a riskless way to make money. A smarter way to do this is with an option called a “covered call“.

You say: Interesting you are using “put”. I call this “Sell Short” or “Short Sale” or take a “Short Position.”

I respond: A put is the writer’s side of the short option — “A short position in a put option is called writing a put. Traders who do so are generally neutral to bullish on a particular stock in order to earn premium income. They also do so to purchase a company’s stock at a price lower than its current market price.” — Investopedia

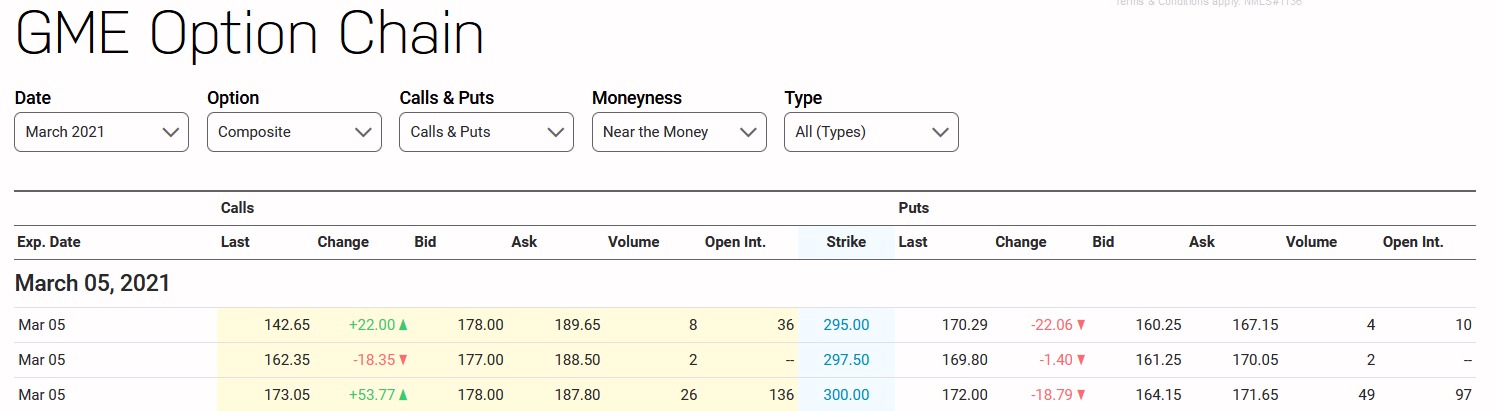

You can buy 1 put option (a contract on 100 shares) with a strike price of $300 that expires on March 5, 2021 for $172/share. If you pay $17,200, you will get an option that allows you to sell 100 shares of GME stock for $300/share between now and March 5. The last days closing price for GME was $325/share. In the event that GME falls below $300/share, you could exercise the option, buy 100 shares on the open market at the lower price and sell it for $300/share. The stock would have to fall below $128/share for you to make a profit. If you do not exercise the option, you lost your $17,200 investment.

RobinHood Investors Steal from the Poor and Give to the Rich (GME / GameStop)