Last week we got to watch the angry young investors invest irrationally making billions of dollars for their favorite hedge funds and the ultra-rich to the tune of 17 billion dollars! Wasn’t that fun?

“Ironically, the army of anti-establishment Reddit traders fattened the fortunes of some of the world’s ultra-rich: Chewy co-founder Ryan Cohen added $1.8 billion; Chinese billionaires Larry Chen and Wang Jianlin added $4.2 billion and $773 million, respectively; and Tootsie Roll CEO Ellen Gordon added $185 million, to name a few.—Andrew Mach”

If you thought that was exciting, stay tuned for the next two weeks as the angry young investors play “Catch the Falling Knife” with their favorite hedge funds. Risk management experts forecast the angry young investors will lose an additional $20 billion to Wall Street.

Spoiler alert: It will be a tragic ending. After the angry young investors put all their money in a bad investment, what will they do next?

You asked: Can you tell me more about the ultra-rich that made billions?

I reply: More important are the hedge funds that made $15-20 billion. You can’t find those numbers easily because they made their money from the positions they already owned (the other side of Melvin Capital’s short sales / puts). There is some reporting you can dig up on it, such as, MUST Asset Management — “GameStop Corp. GME disclosed early Thursday that one of its largest shareholders, South Korea–based MUST Asset Management Inc., no longer held any shares of the videogame and consumer electronics retailer’s shares. MUST had previously owned 3.3 million shares, or about 4.7% of all shares outstanding, which made it GameStop’s ninth largest shareholder, according to data provided by FactSet.”

You question: Are you saying the Reddit gang actually HELPED long position hedge funds as they hurt short position ones?

I respond: Exactly. In this first round 20 billion was transferred from one set of hedge funds to another set of hedge funds. Now, in the next part of the tragedy, the reddit gang will lose their GameStop investment to the same hedge funds… an additional $20 billion or so.

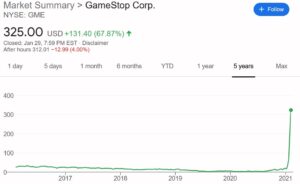

Selling Short / How a Put Works Using GameStop (GME) as an Example