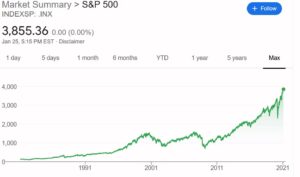

We were talking about a graph of the record high stock market… and, I said:

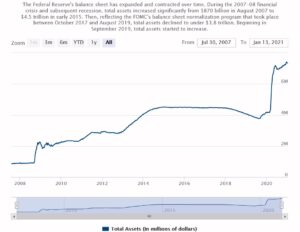

You definitely need to keep this graph with it… the main reason the stock market is at this level is because the Federal Reserve has been buying stocks and bonds… lots of them. (That’s over 7 trillion pictured in the graph.) The old, bankers’ saying is “you can’t fight the fed”.

You asked: So, what will happen next?

I replied:

It all depends on how long the Fed can print money. A goodly portion of the bond and equity markets are owned by the Fed. (aka us / socialism / communism) . The US can do this because the dollar is the world reserve currency. Unfortunately for us, the Trump administration has put the dollar’s status in jeopardy. My guess is we have some time… until the dollar implodes. When the dollar implodes, the artificially inflated real estate, bond, and equity markets will collapse. Something like the next 10-20 years all your assets will be worthless.

You asked: do you think Janet will be Yellen and Screamin’ about this practice?

I replied:

Sad to say, no. The gov’t started propping up the private sector in 2008-2009. That was suppose to unwind. There was no unwinding under Yellen…. the real unwinding was suppose to happen under Trump. In 2017, the unwinding stopped… in 2020, the spigot was opened wide and trillions more were pumping in. Now, it is essential to keep the markets from collapsing. Thus, I expect Yellen will be forced to “Buy high and sell low”. Obviously, a failing investment practice.

ETFs are stocks as are Fannie Mae, Freddie Mac, and Ginnie Mae. Nobody knows exactly what the Fed buys, but it is widely believed the Fed started buying S&P 500 ETFs in 2020. In any event, 7 trillion in public and private debt and equities has a significant impact on artificially inflating real estate and the stock market.

You replied:

I understand it as “ETF’s” are “Exchange Traded Funds” and can be ANY investment vehicle.

To your point the Fed is documented to have made ETF Corporate Bond purchases last year …

What I could use your help on is in seeing how the (to Tom’s point) rather nominal $8 billion purchase is causing the dramatic effect seen in the graph.

I responded:

Yes. “An exchange-traded fund is a type of investment fund and exchange-traded product, i.e. they are traded on stock exchanges as stocks.” The reason(s) it bolsters the stock market include: purchases of corporate bond ETFs; purchase of equity based ETFs; purchase of specific corporate debt (eg Amazon, VISA, Kroger); most importantly the lowering of interest rates so that corporations can borrow money at near zero percent and use the money to purchase back their own stock. These are just a few ways the FED is propping up the stock market. Less direct but just as significant is the inflation of real estate (through purchase of mortgage backed securities.) The inflated value of real estate gives individuals the ability to invest (or not cashout) in the stock market. That is to say, if real estate was not inflated right now, people would be cashing out their 401k and IRAs to survive.

The Fed started doing these dirty deals in 2008. When I say dirty deals, I mean using their authority to maintain liquidity in the markets to interfere in private assets and equity. Since 2008, they have gone further and further over the line. In 2008-2009 it was focused mainly on real estate and large purchases (automobiles). In 2020, the Fed added direct and indirect ownership in corporations. For instance, airline debt… $2.2 million in Southwest Airlines debt. This allowed Southwest to borrow billions to keep afloat during the pandemic. Here is an article that explains a lot of it… “the Federal Reserve announced the deployment of additional “tools to support households, businesses, and the U.S. economy overall in this challenging time.” “Overall, $1 trillion in investment-grade bonds have been issued this year, nearly as much as all of 2019, along with tens of billions more in junk bonds from risky companies, which the Fed has also signaled that it would purchase.”

Something that is very important to consider… what is the difference between owning stock in the corporation or junk bonds issued by that corporation? That is to say, what happens to the Fed’s asset when the corporation goes bankrupt? What happens to the Fed’s good bonds when that company is taken over?

You said:

Something we should all remember … zooming back on the nation with a fresh alien perspective is a great exercise and skill …

We have a median household income barely budge since 1980 even after the majority of households went to duel income. It’s about 62,000 against 300% increases in real estate, health insurance and college costs …

Meanwhile market capitalization, cash reserves and productivity for corporations skyrocketed and the wealth gap of a tiny minority of both private individuals and elected officials skyrocketed …

To say “nothing to see here” is impossible if you look from afar …

This is one thing, the Fed, we can focus on for a better understanding. Thanks Daniel Brouse for initiating the discussion.

I add:

Agreed. The best case scenario for the USA would be to eliminate all existing Federal taxes. Establish a Federal pollution tax. Give every American 40k/year stipend.

The FED really does openly keep 2 sets of books. In general, both the Treasury and the Fed do not want to publicly disclose exactly what they are doing. 1) they don’t want to endanger private companies or industries by giving the impression that a company is in trouble 2) they don’t want the markets to undermine their efforts by trying to profit from their actions. A public example of this is in 2008-2009 when all the big banks were forced to take TARP money… whether they needed it or not. [The Fed and the Treasury have two sets of books… one for the public and one that is classified. It’s why we don’t know what stocks they are buying.)

“Making matters worse, the proportion of buybacks funded by corporate bonds reached as high as 30% in both 2016 and 2017,” according to JP Morgan Chase.

The Fed is buying stocks and bonds. And, the Fed is in cahoots with the Treasury (where do you think the Treasury borrows the money from?) The Fed has purchased trillions of dollars in direct and indirect purchase of stocks and bonds. It started in 2008 and continues to this day. US citizens have ownership in many airlines, cruise ships, real estate, General Motors, Chrysler, a multitude of banks and mortgage companies, insurance companies, and much more. That is not to mention the billions and billions lent to corporations to buy back their own stocks. This is the Fed’s money buying stocks. This is The Fed using the money multiplier to bolster the stock market since 2008.

You ask:

I tried to find data on the “stocks” you are referring to and can’t … does one of the articles you attached above have info.

This also pulls in my skepticism that the media is covering everything it should be … but I just can’t find any info so I could use sources.

I reply:

Yes. You can find out about many of the stocks owned by the government. It is a bit tangled. But, you can follow the money. Ask where the money to purchase the assets comes from? A: The Fed. Corporations and the Treasury obtain near zero interest rate money from the Fed. So, in many cases, how the Fed pays for the stocks becomes obscured. It often takes the private sector years so figure out the cash flow. We don’t know that much about 2020… except what was revealed in the CARES act, as well as, the pattern of stock buy backs (there was a big dip in buy backs in the 2nd quarter that coincides with the stock market.) You will have to dig a bit to find the names of the stocks… but they include airlines (Alaska Airlines, Allegiant Air, American Airlines, Delta Air Lines, Frontier Airlines, Hawaiian Airlines, JetBlue Airways, United Airlines, SkyWest Airlines, and Southwest Airlines), cruise ships, and supply chain companies like Amazon and Kruger. Some of the stock buybacks that lineup with the market include MGM, Best Buy, Qualcomm, Kansas City Southern, Lennar, Cummins and Xerox. The acquisition of stocks and stock options from earlier periods has been better routed out by analysts… all of the companies listed in “red” are all on the list: https://projects.propublica.org/bailout/list

You wondered: Am I missing something … these appear to be loans, not stock purchases, yes?

I explain: In 2008 the Federal Reserve and the Treasury colluded on circumventing the restriction on the both the Fed and the Treasury. Now, they are working in concert. You can no longer differentiate between the Fed and the Treasury. Quantitative Easing (QE) and the Troubled Asset Relief Program TARP) completely changed how things worked. (You can see it in the original chart above.) In most instances, the Treasury enters into stock ownership agreements and uses the Fed’s money to complete the deal. So, is it the Fed? or is it the Treasury? is the wrong the question… the right question is “Is it the Fed and treasury? The answer is yes. Now, most of the purchases/deals are under the CARES act. This is in addition to the Fed’s direct investment in public and private bonds, as well as, equities. The Fed is buy ETF’s and individual stocks, as well as… but the public can not find out exactly which ones.

It is very convoluted and in my opinion illegal. Neither the Fed nor the Treasury should be intervening / competing in the private markets. It costs the average citizen a lot of money.

The simplest way to explain is comparing it to an individual trading options with a margin account. In this scenario, the Treasury would be the account holder and the Fed would be the broker — “Buying on margin involves borrowing money from a broker to purchase stock. A margin account increases your purchasing power and allows you to use someone else’s money to increase financial leverage. Margin trading confers a higher profit potential than traditional trading but also greater risks.”

The most important part might be to start with the fact that there should be NO assets on the Fed’s balance sheet. The Fed is suppose to be the banks’ bank… regulating banks to maintain their liquidity and control inflation. Q. Is the Fed part of the government? A. No. The Federal Reserve Banks are not government agencies. The Federal Reserve is quasi-governmental. The Fed is not suppose to lend money to anyone other than member banks and only “overnight” to meet reserve requirements. (Reserve requirements are suppose to be to ensure banks remain solvent.)

Though this is not rocket science, it is convoluted high finance shell games. Very similar to investigating money laundering.

Economics and civics should be taught in every grade K-12 IMHO