by Daniel Brouse

April 3, 2025

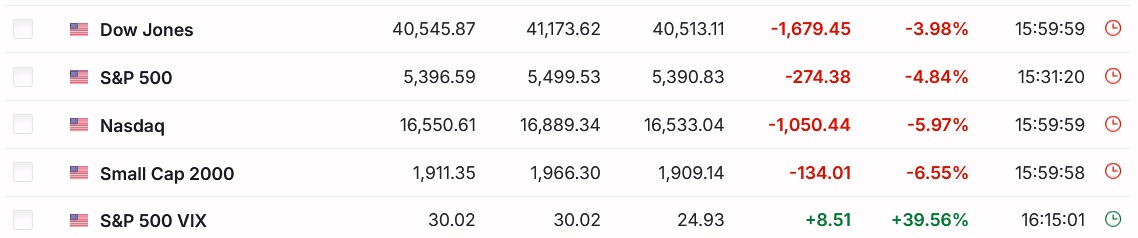

The VIX (Volatility Index), often called the “fear gauge,” measures market expectations of volatility over the next 30 days. A 39.56% spike in the VIX is highly significant and suggests extreme uncertainty and fear among investors.

Key Implications of Today’s VIX Surge:

-

Panic Selling & Market Turmoil – A spike of this magnitude indicates that investors are rushing to hedge against potential losses, suggesting widespread concern about the stability of financial markets.

-

Unprecedented Trade War Concerns – This surge likely reflects the market’s reaction to the sweeping tariffs imposed by the U.S. on 180 countries, which could disrupt global supply chains, increase costs, and slow economic growth.

-

Historical Context – The last time the VIX saw a spike of this scale was during major economic crises, such as the 2008 financial meltdown or the COVID-19 market crash in 2020. This suggests that investors believe the current trade war could have long-term recessionary effects.

-

Liquidity & Credit Market Strain – Rising volatility can impact corporate borrowing, investment decisions, and economic confidence, potentially leading to tighter credit conditions and reduced consumer spending.

-

Potential for a Bear Market – If this volatility persists, it could mark the beginning of a prolonged downturn similar to what was seen in the Great Depression or the 2008 financial crisis.

In short, today’s 39.56% VIX spike signals extreme fear and uncertainty, with investors bracing for significant market disruptions due to escalating trade tensions.

- Trade War!

On April 2, President Trump unilaterally declared a trade war against the rest of the world, imposing protectionist tariffs on 180 countries—calling it “Liberation Day.” This action was taken without congressional approval and in direct violation of the Constitution. - US Vs. Everyone

A coalition of world leaders from diverse countries has come together to voice concerns about the U.S. tariff policies under President Donald Trump. Countries such as Australia, Canada, Japan, New Zealand, Taiwan, South Korea, and other major U.S. partners have not only condemned Trump’s actions but have also voiced the potential economic damage these tariffs could inflict. These nations are now positioning themselves to take collective action, highlighting a shift in the global dynamic that risks isolating the U.S. on the international stage.European Commission President Ursula von der Leyen was particularly vocal in her remarks, emphasizing the far-reaching consequences of these trade policies. “The consequences will be dire for millions of people around the world. We are ready to respond,” she declared, signaling Europe’s readiness to take countermeasures. The European Union, along with other countries, is preparing a coordinated response to the tariffs, which could include retaliatory tariffs. economic sanctions, and boycotts.