By Daniel Brouse

July 19, 2024

“Perhaps most importantly is the repeated use of the phrase ‘Drill, Baby, Drill’.”

Economic Update:

If Trump wins, great news for the very few people whose primary income comes from government securities interest! Unfortunately, very, very bad news for everyone else.

Tariffs, protectionism, lack of immigration, and nationalism are all detrimental to the economy. Tariffs and protectionist policies can lead to trade wars, higher consumer prices, and disruptions in the supply chain, which can stifle economic growth. Limiting immigration reduces the labor force and can slow down innovation and productivity, as immigrants often contribute significantly to economic dynamism. Nationalism can lead to isolationist policies that hinder international cooperation and trade, further damaging the economy. Over the last several years, approximately 80% of economic growth can be attributed to immigration.

Should Trump win, there is a concern that the U.S. may face economic decline similar to his six personal bankruptcies. His previous administration’s policies on tariffs, immigration restrictions, and nationalist rhetoric have already shown signs of economic strain. Continued implementation of such policies could exacerbate these issues, leading to a weakened economy and reduced global competitiveness for the U.S. It is crucial to adopt inclusive and cooperative economic strategies to foster sustainable growth and stability.

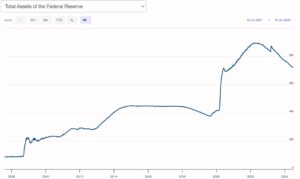

Interest rates are likely to spike and remain high for an extended period. In 2019, under the Trump administration, the Federal Reserve balance sheet saw a massive increase of $4 trillion in a very short period. This unprecedented expansion of the money supply, combined with the administration’s tax cuts and significant government spending, contributed to record inflation levels. The rapid increase in the money supply, aimed at stimulating the economy, led to an oversupply of currency, diminishing its value and driving prices up.

The former President has also made claims that he will lower interest rates if he returns to office. The good news is that he doesn’t have the authority to directly lower rates, as this is the Federal Reserve’s responsibility. However, what used to be reassuring news is now less so. With the rollback of Chevron regulations, potential economic instability could lead to disastrous consequences, including further inflationary pressures and financial market disruptions.

Additionally, the tax cuts, while boosting short-term economic growth, significantly reduced federal revenue, leading to increased borrowing and higher national debt. The substantial government spending further exacerbated this issue, creating a fiscal environment prone to inflation. As a result, the Federal Reserve had to raise interest rates to combat inflation and stabilize the economy.

High interest rates can slow down economic growth by making borrowing more expensive for consumers and businesses, potentially leading to reduced investments and spending. This can create a challenging economic environment, underscoring the need for balanced fiscal policies that promote sustainable growth without leading to excessive inflation.

The former President recently stated that he wants a ‘weaker dollar.’ A devalued dollar on international markets can lead to numerous economic challenges, including significant impacts on inflation and interest rates. A weaker dollar makes U.S. exports cheaper and more competitive abroad, potentially boosting manufacturing and trade. However, it also increases the cost of imports, leading to higher prices for consumer goods and contributing to inflation.

Additionally, a weaker dollar can affect interest rates as the Federal Reserve may adjust monetary policy to manage inflationary pressures, impacting borrowing costs for consumers and businesses. Another concern is the impact on foreign investment. Treasury securities are popular among foreign investors because they are considered a safe investment. However, if the dollar devalues, the return on these investments may decrease when converted back to the investor’s local currency. To attract foreign investment despite the weaker dollar, the U.S. may need to offer higher interest rates on Treasury securities.

These economic landmines highlight the complexities and potential risks associated with currency devaluation.

Perhaps most importantly is the repeated use of the phrase ‘Drill, Baby, Drill’. The phrase encapsulates a harmful approach to energy policy that prioritizes fossil fuel extraction over sustainable practices. Climate change, exacerbated by such policies, poses the most severe threat not only to our environment but also to our economy.

In 2023, the U.S. experienced a record number of climate disasters, each exceeding one billion dollars in damages, with a total of 28 separate weather and climate-related events. Some of these individual events cost the U.S. economy hundreds of billions of dollars. The frequency and severity of these events are alarming, reflecting the accelerating pace of climate change.

The economic impact of climate change is expected to be staggering, with projections indicating it could cost the U.S. economy trillions of dollars. The financial burdens arise from various sources, including the destruction of infrastructure, increased healthcare costs due to climate-related illnesses, disruptions to agriculture and food supply, and the need for extensive disaster relief and recovery efforts. One of the primary drivers of the current inflation spike is the rising cost of homeowners insurance due to climate disaster-related claims. Short sellers anticipate that within ten years, 25% of U.S. properties will be uninsurable. These costs will continue to rise unless significant measures are taken to mitigate climate change and transition to a more sustainable energy system.

Moreover, the long-term economic effects of climate change can hinder economic growth, reduce productivity, and increase social inequalities. Proactive investments in renewable energy, climate resilience, and sustainable practices are essential to curtail the financial and environmental impacts of climate change. These measures are crucial to protect both the environment and the economy from the devastating impacts of climate change.