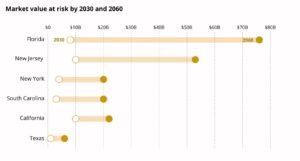

The rising sea level is putting a trillion dollars of real estate at high risk.

“The question is no longer if rising seas will erode coastal home values, but who will get stuck with the devalued assets when the markets turn,” reported Dee Gill.

“Alarmingly, more than half of that (at-risk property) exposure is estimated to lie outside FEMA flood zones. That means those properties are at higher risk of being underinsured, and, therefore, the loans attached to them are at higher risk of impairment, with increased risk for the value of the related CMBS (securities).” —CFTC

“Fannie and Freddie carry about $5.6 trillion in assets, mainly home mortgages and related securities. Ultimately, taxpayers backstop the payments on loans under the agencies’ control, UCLA’s Yu explains. Their regulator, the Federal Housing Finance Agency, issued a request for information in January, in part to assess flood risks. The entities require flood insurance that might mitigate their losses only on properties inside FEMA’s poorly drawn flood zones. Coverage limits imposed by NFIP — $250,000 for the structure and $100,000 for personal property — mean many coastal homes that have coverage are grossly underinsured.” — UCLA / Is the $1 Trillion Coastal Housing Market a Future Financial Crisis?

BlackRock, the G20-backed Financial Stability Board and the U.S. Commodity Futures Trading Commission are voicing concerns about unflagged flood risks squirreled away in mortgage-backed securities, bond markets and other real estate-backed investments. Common themes: The exact size of exposure is elusive but big; markets don’t currently price for it; these assets pose a threat to the stability of the global financial system.