by Daniel Brouse

March 28, 2025

Gold: A Growing Influence in Today’s Market

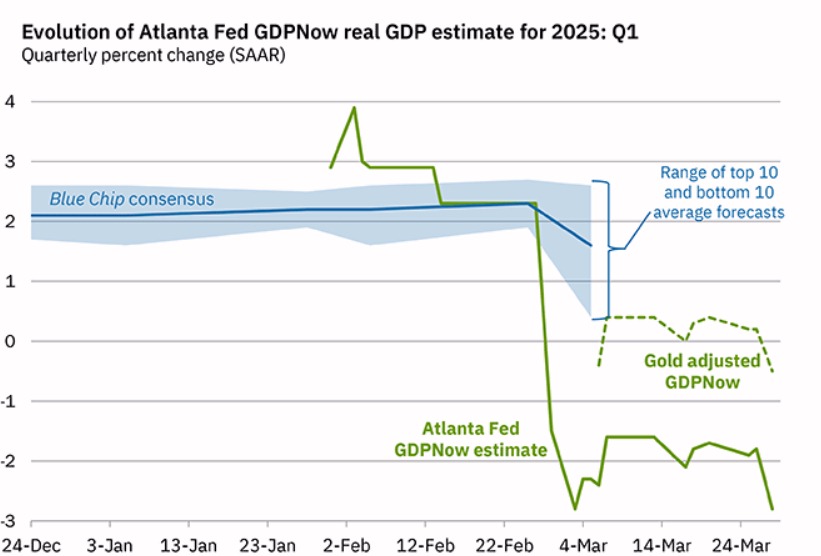

Gold has always been a significant asset in the global financial landscape, but recently, its influence has grown in ways not seen for quite some time. One key reason for this increased attention is its impact on the Atlanta Federal Reserve’s GDPNow tracker. In fact, the Fed had to add a special line in its graph to account for the significant influence of net gold imports on U.S. GDP. This is not a typical occurrence and signals that gold is playing a more prominent role in the economy than it has in recent decades.

Why is Gold Significant?

Gold is generally considered in two primary ways: as a store of wealth and as a commodity used in products such as jewelry and electronics. Traditionally, gold flows have been relatively stable. That means the Fed typically does not focus much on gold as it doesn’t typically cause significant economic disruption or fluctuation. However, recent trends have shown an increase in gold imports that is disproportionate to other sectors of the economy. This surge has been so large that it has skewed GDP calculations, prompting the Fed to specifically acknowledge it.

The challenge with accurately tracking gold’s economic impact stems from how it is measured and classified. Imports and exports of gold can be difficult to track, especially considering the different forms in which gold is used. It is not always clear whether gold is entering the country for industrial use or simply as a hedge against economic uncertainty, making it harder for analysts to determine its full economic impact.

The Fed’s Usual Disregard for Gold

So why doesn’t the Federal Reserve usually pay more attention to gold? In past decades, gold flows were relatively predictable and static. It was a safe asset that largely served as a store of value, with only small fluctuations in demand. Therefore, gold didn’t play a significant role in influencing broader economic data like GDP growth. This predictability, combined with the move away from the gold standard, meant that gold was seen as less relevant in day-to-day monetary policy decisions.

However, recent patterns have changed. A combination of global economic uncertainties, inflation fears, and geopolitical tensions has led to a surge in demand for gold as a safe haven asset. As a result, huge gold imports have recently overshadowed other aspects of the GDP, pushing the Federal Reserve to reconsider its influence.

What Does This Mean for You?

For the average investor, the growing prominence of gold has several potential implications. The most significant impact could be felt if you have a 401(k), invest in mutual funds, or hold ETFs. Many of these investment vehicles, particularly index funds and mutual funds, are required to stay fully invested in the market. This can leave investors vulnerable during periods of market volatility or when certain asset classes, like stocks, are underperforming.

In these times, it might be wise to consider reducing risk, or “beta,” in your portfolio. This means adjusting your investment strategy to become more defensive, moving away from riskier equities, and diversifying into other assets—such as gold. By reallocating a portion of your investments into gold, you can help hedge against volatility, preserve wealth, and potentially capitalize on gold’s rising demand. This is especially pertinent when traditional markets experience instability, and gold continues to serve as a long-standing safeguard against inflation and market turmoil.

The Bottom Line

The growing significance of gold in today’s economic environment is not a passing trend. As illustrated by the Fed’s GDPNow tracker, the surge in gold imports is not merely a statistical anomaly but a clear indication of broader economic shifts. Such movements in asset flows are valuable signals for individual investors, offering insight into changing market dynamics. Other key indicators to watch include currency and credit flows, which also provide clues about the direction of the economy. However, for small investors, participating directly in many of these trades can be challenging—especially with issues like storing gold, soy, or pork bellies.

In times like these, your best investment strategy is likely to focus on tangible assets. Housing should remain your largest asset, offering long-term stability and growth potential. For additional savings and retirement funds, consider allocating 90% to short-term treasuries, 5% to Treasury I Bonds, and 5% to gold and other real assets. This diversified approach can help protect your wealth and provide a hedge against economic uncertainty.

Capital Preservation During Trumpenomics

- Economic Survival 101: Liquidity & Long-Term Strategy

- Dump Trump: Buy and Hold Doesn’t Hold

- Mandated Buyers vs Emotional Sellers: The Battle Behind Every Crash

(Why doesn’t the stock market just crash in a straight line?) - The Great Depression vs. The Climate Crisis: Why the Stock Market May Never Recover

- Trumponomics and Its Impact on U.S. GDP

- Trump’s Housing Finance Reforms: Privatization and Deregulation Amidst Controversy

- Economic Update: Should I Panic Yet?

- Investment Strategy: When ‘America First’ Is Last

- Tariffs and the Liquidity Crisis in Long U.S. Treasuries