by Daniel Brouse

April 8, 2025

Primer: The Chaos Theory of Crashing Markets

Why doesn’t the stock market just crash in a straight line?

Short Sellers in Short:

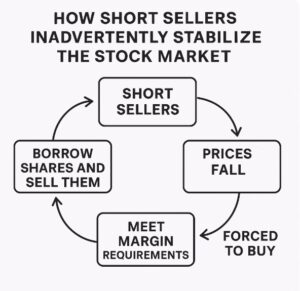

Short sellers inadvertently stabilize the market because when prices fall too far, too fast → their margin requirements force them to buy stock to cover losses → creating upward buying pressure → which puts a floor under falling prices.

This happens automatically even if short sellers are betting against a stock — because their broker doesn’t care about their opinion, only about risk.

Step-by-step: How it works

1. Short sellers borrow shares and sell them

→ They hope to buy back later at a lower price.

Example:

-

Short seller borrows and sells 100 shares at $50 = $5,000 proceeds.

2. If the stock price rises, losses are unlimited

→ If price goes from $50 → $75 → $100 → $200 → Losses grow exponentially.

3. Brokers set margin requirements

→ Short sellers must have enough collateral (cash or assets) to cover potential losses.

→ If stock price rises or becomes volatile, margin calls happen.

4. Forced buying happens on margin calls

→ If a short seller can’t meet the margin requirement, the broker will buy back the stock on their behalf to close the position.

→ This buying happens regardless of fundamentals — it’s a risk-control mechanism.

5. The stabilizing effect

→ When markets are falling and lots of people are short → at some point, shorts must take profit or cover losses.

→ That buying pressure offsets panic selling.

→ Result: Short sellers, ironically, help prevent free-fall crashes from going on indefinitely.

Why is this stabilizing?

-

Short sellers add liquidity on the way down (by selling into overvalued prices).

-

They add demand on the way up (when forced to cover or take profits).

It’s like a shock absorber:

→ They accelerate down-moves initially → but put a floor under them eventually.

Caveat:

If too many people are short → this can create short squeezes — where forced buying causes prices to overshoot upward. (See: GameStop 2021)

Bottom line:

Short sellers stabilize the market — not because they want to — but because risk management rules force them to act in ways that counter extreme price moves.

→ Sell high → Buy low

→ But margin rules ensure that “buy low” can’t wait forever.

Flow:

-

→ Short Sellers borrow shares & sell

-

→ Prices fall — their bet is working

-

→ But if Prices rise or get volatile

-

→ They hit Margin Requirements

-

→ Forced to Buy Back shares

-

→ That buying pressure helps Stabilize Prices

Structural, Non-Emotional Buyers

Another big stabilizing force: Structural, non-emotional buyers — like mutual funds, index funds, pensions, and insurance companies — that must stay invested due to their mandates.

Even when panic selling hits, there are built-in sources of demand that automatically slow or reverse sell-offs — not because they “like the market” — but because of rules, math, and fiduciary responsibility.

Key Stabilizing Forces in a Sell-Off

1. Index Funds (Passive Funds)

-

Mandate: Match an index (S&P 500, Nasdaq, etc.)

-

Sell-off impact: When markets drop, they often receive inflows from 401(k)s, IRAs, target-date funds.

-

Result: They are forced to buy proportional amounts of every stock in the index — including the falling ones.

2. Mutual Funds (Active Funds)

-

Mandate: Typically must stay 90%-100% invested.

-

Sell-off impact: If they get cash inflows from investors seeing a dip as a buying opportunity → they have to deploy that cash → buying falling stocks.

3. Target-Date Retirement Funds

-

Mandate: Automatically reallocate to equities after big drops (to maintain stock/bond ratios).

-

Sell-off impact: If stocks crash and bonds stay flat → they rebalance → forced stock buyers.

4. Insurance Companies & Pensions

-

Mandate: Long-term liabilities require long-term assets → stocks are part of that.

-

Sell-off impact: They may be value buyers in panic sell-offs to lock in future returns.

5. Corporate Buybacks

-

Mandate: Pre-approved buyback plans often accelerate when shares fall below certain levels (seen as “cheap”).

-

Sell-off impact: Automatic buy demand from companies themselves.

Visualizing the Market Feedback Loop in a Crash:

↓ Panic Selling

Retail → Hedge Funds Selling

↓

Short Sellers Covering (forced buying)

↓

Index Funds Rebalancing (forced buying)

↓

Mutual Funds Deploying Cash (mandated buying)

↓

Corporate Buybacks Engaging (value-based buying)

↓

Stabilization → Recovery

Bottom Line:

Sharp sell-offs don’t happen in a vacuum.

The deeper and faster the drop:

-

The more forced buyers appear due to structural mandates.

-

The more cash gets deployed automatically.

-

The more short-sellers are forced to buy back.

This is why stock market crashes — unless driven by systemic financial collapse — often slow down or reverse before valuations hit absurd lows.

Here’s how a crash works:

1. Stabilizers Create “Speed Bumps,” Not Floors

-

Short-seller covering, passive fund buying, and corporate buybacks don’t prevent a crash.

-

They just create temporary demand pockets → slowing or reversing declines briefly.

-

These speed bumps make the crash feel chaotic, not orderly.

→ Sharp Drop

→ Violent Bounce (forced buying, covering, rebalancing)

→ New Selling Pressure (fund redemptions, fear returns)

→ Another Drop

→ Another Bounce

→ Capitulation (selling exhaustion)

→ Bottom (nobody left to sell)

This is why crashes often feel like:

→ “Crash → Bounce → False Hope → New Lows → Panic → Stabilization”

2. No Guaranteed Floor

Even with all these stabilizing forces, there is no rule that says:

“The market must bottom here.”

If:

-

Fear overwhelms forced buying

-

Credit markets seize

-

Massive fund redemptions hit

-

Systemic risk (Lehman, 2008 style) emerges

→ Those stabilizers can get run over.

3. Stabilizers Work Best in Liquidity-Driven Sell-Offs

They work poorly in:

-

Credit crises

-

Systemic failures

-

Policy mistakes

-

Liquidity completely drying up

They work best when:

-

It’s a valuation correction

-

Sentiment-driven panic

-

Over-leveraged speculators unwinding positions

Visual: What the Price Path Looks Like

Smooth drop? Nope.

Price

^

| bounce

| /¯¯¯¯¯¯\

| \bounce /¯¯¯¯¯¯ \___

| \/ \

| / \__

| / \

|————————————————————-> Time

Bottom Line:

→ Stabilizers don’t prevent crashes.

→ They just interrupt them.

→ They inject buying at unpredictable moments → creating volatility spikes, not smooth declines.

→ If fear or liquidity risk is greater than the stabilizing force → new lows come.

→ But the deeper the drop, the stronger those stabilizing forces eventually become.

Why This Crash is Different

What makes this crash different? It’s self-inflicted. Unlike past downturns driven by credit bubbles or external shocks, this slowdown is the result of deliberate policy choices. The combination of restrictive immigration, escalating tariffs, and poorly coordinated climate responses has created a global drag on growth unlike anything since the Great Depression. This isn’t just a business cycle — it’s structural. If nationalist, isolationist, and protectionist policies persist, it’s possible that markets won’t fully recover for a generation — or at all.

REFERENCES:

Primer: The Chaos Theory of Crashing Markets

- State of the Economic Union: Still Horrible

- Credit War!

- Stock Market Update: A Worsening Economic Landscape

- Tariff Turmoil: The Chaos and Confusion Surrounding U.S. Trade Policies in 2025

- America’s Trade War Is Costing More Than We Realize — It’s Costing Global Trust

- The Destructive Legacy of Trump’s Climate and Economic Policies: A Call for Urgent Action

Protectionism 101: Trump Economics

It’s honestly hard to watch this and understand how any of his followers are falling for what has to be the worst attempt at “Don the Con” yet. I can’t find a single credible economist who agrees with Trump on this. Eliminating immigration and launching a trade war at the same time isn’t strategy — it’s economic suicide. It’s like going nuclear on your own economy. I’d say someone needs to take the “codes” out of his hands — but it’s too late. He’s already launched them.

- Trumpenomics: How Tariffs, Policy Cuts, and Labor Shortages Are Devastating American Farmers

- The Devastating Impact of Trump’s Steel and Aluminum Tariffs

- Tariffs: The Most Regressive Tax That Hurts the Economy Without Reducing the Deficit

- World Economics 101: The United States and Global Trade Dynamics

- The Lies Behind Trump’s Terror Economics

- A Storm Brewing in Global Trade

- The Economic and Diplomatic Consequences of Trump’s Tariff Expansion

- The Hidden Costs of Short-Term Gains: Inflation, Tariffs, and Fiscal Recklessness

- How Tariffs on Guitars and Pianos Could Impact the Next Generation of Musicians

- Trump’s Sector-Specific Tariffs

- Liberation (From Your Money) Day: Largest Tax Increase in History

- Tariff Theater: Trump’s Economic War on the World — Including Penguins

- Trade War!

On April 2, President Trump unilaterally declared a trade war against the rest of the world, imposing protectionist tariffs on 180 countries — calling it “Liberation Day.” This action was taken without congressional approval and in direct violation of the Constitution.

FORECASTS COME TO FRUITION

Drill, Baby, Drill (How Hate and Ignorance Distort Economic Perspectives)

July 2024 – Pre-Election Warning: Concerns were raised about candidate Trump’s proposed economic policies, highlighting potential unintended consequences such as heightened inflation and increased national debt—both of which could undermine economic stability. Additionally, experts cautioned that his administration’s environmental stance, including withdrawing from the Paris Agreement and rolling back over 100 environmental regulations, could have devastating effects on both the economy and the environment. Now, much of this forecast is unfolding before our very eyes.

Economic Outlook 2025 – 2035

November 2024 – Post-Election Analysis: Concerns are mounting over the potential consequences of President Elect Trump’s proposed economic policies, particularly their impact on inflation, national debt, and climate change. The Committee for a Responsible Federal Budget estimates these policies could add $7.75–$10 trillion to the national debt over the next decade. Additionally, projections suggest inflation could rise to at least 6% by 2026, with consumer prices potentially increasing by 20% by 2028. These forecasts have since been revised, reflecting higher inflation and slower economic growth, compounded by the significant fallout of an ill-conceived trade war.

Financial Disclosure: Trump’s Crimes and Conflicts of Interest

This article examines financial disclosure and conflict-of-interest regulations for U.S. presidents and officials, highlighting the ethical expectations and legal requirements for transparency. It discusses President Donald Trump’s failure to meet traditional financial disclosure norms, including his refusal to divest from business interests, his lack of transparency in financial reporting, and documented conflicts of interest.